How to Apply for an ITIN: A Complete Guide

Are you wondering how to apply for an ITIN? If you’re a non-resident or resident alien, a dependent, or a spouse of a U.S. citizen or resident alien, you might need an ITIN to file your taxes in the United States. This guide will walk you through everything you need to know about applying for […]

Understanding ITIN vs SSN Differences

What is an ITIN? An ITIN, or Individual Taxpayer Identification Number, is an essential tool for people who need to report their taxes but do not have a Social Security Number (SSN). This usually applies to non-resident aliens, their spouses, and dependents. It’s interesting to note that I remember my friend, who moved to the […]

Your Complete ITIN Renewal Guide

Understanding ITINs So, what exactly is an ITIN? ITIN stands for Individual Taxpayer Identification Number, and it’s essential for people who need to file taxes but don’t have a Social Security Number. Often, folks from different countries working or living in the U.S. apply for an ITIN. I remember when my friend Maria moved here […]

Understanding ITIN for Non-Residents

What is an ITIN? Individual Taxpayer Identification Number (ITIN) is basically a tax processing number issued by the IRS (Internal Revenue Service) for individuals who aren’t eligible for a Social Security Number (SSN). So, if you’re a non-resident or a foreign national, and you need to file taxes in the U.S., this little number becomes […]

Essential ITIN Tax Filing Tips

Understanding ITIN Basics If you’re unfamiliar with what an ITIN is, it stands for Individual Taxpayer Identification Number. Basically, it’s a nine-digit number that the IRS assigns to individuals who are required to have a U.S. taxpayer identification number but do not qualify for a Social Security number. This can be particularly important for non-resident […]

Understanding ITIN Benefits and Limitations

What is an ITIN? An Individual Taxpayer Identification Number, or ITIN, is really important for various groups, especially non-resident aliens and those who are not eligible for a Social Security Number (SSN). I remember back when I was sorting out my finances, I found out about the ITIN while looking for tax help. It’s issued […]

Understanding ITIN Expiration and Renewal

What is an ITIN? An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the IRS to those who need to comply with U.S. tax laws but are not eligible for a Social Security number. This includes foreign nationals, dependents, or even some residents. The ITIN is used primarily for tax […]

Understanding ITIN for International Students

What is an ITIN? An ITIN, or Individual Taxpayer Identification Number, is a crucial aspect of the U.S. tax system, especially for many international students. Think of it as a social security number for those who don’t qualify for one. Essentially, if you’re a non-resident alien who needs to file a tax return, the ITIN […]

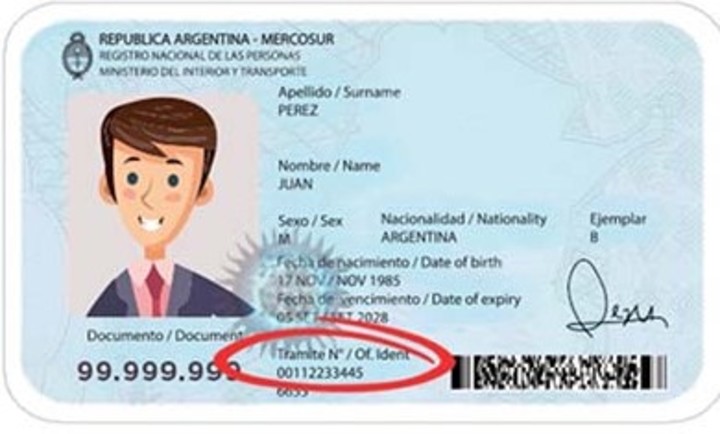

Essential Documents for ITIN Application

What is an ITIN? An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). It’s meant for individuals who are required to furnish a taxpayer identification number but don’t have, and so cannot get, a Social Security Number (SSN). This is common among non-residents or foreign nationals […]

Understanding ITIN Processing Time

What is an ITIN? So, let’s break it down: an ITIN, or Individual Taxpayer Identification Number, is a nifty little thing that the IRS issues to people who aren’t eligible for a Social Security Number but still have tax obligations. Many times, this is for non-residents or those who are foreigners living in the U.S. […]