What is an ITIN?

An ITIN, or Individual Taxpayer Identification Number, is a nine-digit number issued by the IRS specifically for tax purposes. It’s primarily designed for individuals who have a tax filing obligation in the United States but don’t have a Social Security Number (SSN). I remember when I first heard about ITINs—it was during a tax workshop I attended. Folks from diverse backgrounds shared their stories about navigating the tax system without the typical means of identification. It struck me then how vital this number is for many. ITINs allow people like non-resident aliens, their spouses, and dependents to report their income and file their taxes legitimately.

Even if you’re not in the US legally, like international students or foreign workers, you have to ensure you’re compliant with tax laws. Also, having an ITIN can, in some cases, help in certain banking activities, such as opening an account. So, if you find yourself in a situation where you need to file taxes and don’t qualify for an SSN, an ITIN could be your solution. It’s essential for fulfilling your tax duties while living or working here.

Common Misconceptions About ITINs

There are quite a few misconceptions floating around about ITINs, and I think it’s super important to clear the air! One of the biggest myths is that people often believe having an ITIN means you’re authorized to work or live in the US. That’s not true! An ITIN is strictly for tax reporting purposes and does not grant immigration status. If you’re not sure what you can do with your ITIN, remember it’s just a tool for filing taxes, kind of like my old abacus! Another misconception is that ITINs can only be used by undocumented immigrants, which isn’t the case.

In fact, many legal residents, such as international students, also need an ITIN to fulfill their tax obligations. It’s a common theme I see during tax season—the lack of understanding around what an ITIN really is and isn’t. It’s crucial to separate fact from fiction, as misinformation can lead to unnecessary anxiety for those who need to navigate tax responsibilities. The more you know, the better prepared you are!

Why Do You Need an ITIN?

So, you might be wondering, why exactly would you need an ITIN? The primary reason is for tax purposes, as I’ve mentioned already. But that’s not the whole picture! An ITIN comes in handy in various situations, like when you need to file a tax return or claim certain tax benefits, like the Child Tax Credit. For example, think about a family where the parents are foreign workers—they want to file their taxes to comply with US laws and ensure their kids can enjoy some benefits. That’s where an ITIN makes it smooth for them.

Moreover, it can help border-crossers secure some loans or open bank accounts, so they can manage their finances more easily in the US. A friend of mine had trouble getting a loan at first because he didn’t have a Social Security Number; once he got his ITIN, it was much easier. Overall, having an ITIN gives you more legitimacy in your financial dealings and can really help access resources that Americans often take for granted.

Benefits of Having an ITIN

Let’s chat about the benefits of having an ITIN—there are quite a few! First off, having a way to file taxes legitimize your presence in the tax system. I remember an acquaintance who felt stuck about his financial options due to lacking an ITIN. Once he got his number, he began to see opportunities he hadn’t considered before. ITIN holders can take advantage of various tax credits and deductions that help lessen the tax burden. Also, it’s helpful when you open a bank account—certain banks allow ITINs for accounts, meaning that even those who may not yet have residency can still manage their finances.

Another great benefit is that holding an ITIN can be beneficial for applying for loans or mortgages, making it easier to settle down or expand your horizons in life! It’s kind of like when I finally bought my first car; having the right paperwork made everything feel more accessible. Overall, having an ITIN opens doors that might otherwise be closed.

Maintaining and Renewing Your ITIN

Now that you’ve got an ITIN, how do you maintain or renew it? This part can be a bit tricky, especially when some folks think they can set it and forget it. You won’t want to do that! The IRS has specific guidelines about renewing ITINs, particularly for those not used on a tax return in the last three years. It’s a good reminder that says hey, if you’ve not used your ITIN recently, it might need a little refresh!

Typically, you’d want to submit Form W-7 to renew it, along with updated information or documentation. What I find interesting is how the IRS updates their policies from time to time, so staying informed is essential. There was a time last year where the IRS introduced new pathways for renewal, and many people were quite excited. Plus, keeping track of your ITIN’s status and understanding when to renew can help avoid unnecessary tax complications down the road. So, always be aware, because your ITIN is like having a little badge that helps you navigate through life in the tax world!

How to Apply for an ITIN

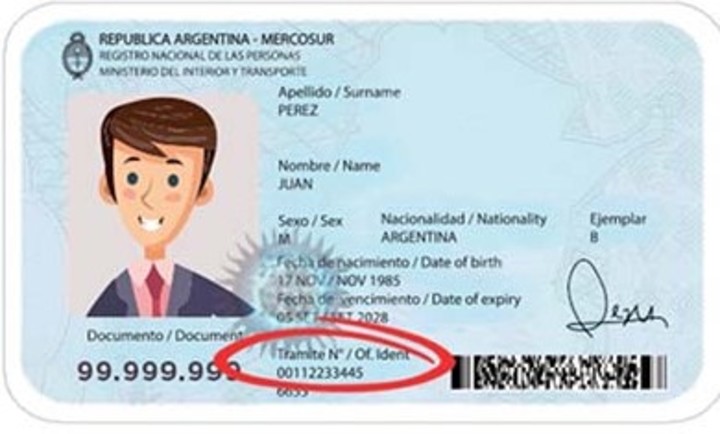

Applying for an ITIN might seem overwhelming at first, but trust me, it isn’t as complicated as it appears! The IRS allows you to apply for an ITIN by filling out Form W-7, which is quite user-friendly. In fact, I remember when I had to help a friend fill out this form—it was a bit like tackling a puzzle, but once we pieced everything together, it felt like we conquered this small beast! You’ll need to provide documentation proving both your foreign status and identity, such as a passport or other approved documents.

It’s essential to ensure everything is accurate and complete to avoid delays. You can submit the form and documents either by mail or in person at designated IRS Taxpayer Assistance Centers. Also, if you’re filing a tax return simultaneously, you can attach it with your W-7 application. Just keep in mind that there are deadlines for filing taxes, so don’t procrastinate too much. The IRS usually processes ITIN applications within a few weeks—so just be patient after applying, and you’re on your way to sorting your tax needs!