ITIN application documents, learn what it is, who needs it, and how to apply effectively. Ensure compliance and navigate U.S. taxes confidently!

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS). It’s meant for individuals who are required to furnish a taxpayer identification number but don’t have, and so cannot get, a Social Security Number (SSN). This is common among non-residents or foreign nationals who are working in the U.S. or have U.S. tax obligations. Now, I remember when I first came across the ITIN process. It seemed confusing at first, but once I understood its necessity—especially for filing taxes—it made total sense. The ITIN is especially helpful for independent contractors, freelancers or anyone who short-term visiting the U.S. but still needs to report their income. It ensures that even if you don’t qualify for a Social Security Number, you can still meet tax laws and regulations. Plus, having an ITIN can sometimes even help you secure certain financial services in the U.S., like opening a bank account. So, if you’re on this journey, you’re definitely not alone. Many people have had to navigate through this process and came out on the other side with clarity. Let’s dive deeper into what you need to apply for one.

Common Mistakes to Avoid

When applying for an ITIN, avoiding common mistakes can save you time and frustration. One of the biggest hiccups I faced was not double-checking my information. Even a small typo can lead to delays or denials. Make sure your name and details match what’s on your supporting documents exactly. Speaking of supporting documents, another frequent error is not sending in the original documents as required. The IRS wants to see these documents in person, so don’t cheap out on making a copy—they might reject your application otherwise. It’s worth it to ensure everything is in order. Also, don’t forget to sign your Form W-7; believe it or not, I’ve seen folks forget this and end up losing precious time. Another tip is to be mindful of deadlines. If you’re applying for an ITIN specifically for tax filing, time it accordingly so you don’t miss your chance. Keep these pointers in mind, and you’ll skip many of the pitfall others hit. It’s all about paying attention to the details!

Key Documents Required

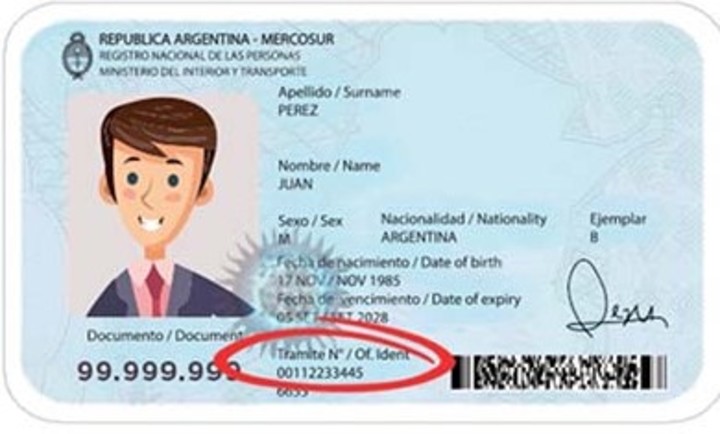

Now, gathering the right ITIN application documents can be a bit of a task, but don’t fret! Primarily, you’ll need to prepare Form W-7, the IRS application for an Individual Taxpayer Identification Number. This form is quite straightforward but requires you to fill out details like your name, mailing address, and a few personal details. Along with Form W-7, you’ll need to provide documents that prove both your identity and your foreign status. This usually involves submitting an original, valid passport, or alternatively, two documents like a national identification card and a birth certificate; but always make sure they meet IRS requirements. I’ve been there, and there’s sometimes a sense of panic when trying to find everything in one go. Trust me; it’s worth checking with the IRS website or a tax professional to make sure your documents are correct. It’s like trying to piece together a puzzle. Once you have everything sorted, the next step will feel so much easier. Keep it organized, and you’ll be golden!

Who Needs an ITIN?

You might be wondering if you really need an ITIN. The answer is quite clear if you meet specific criteria. Those who are non-resident aliens, U.S. resident aliens, or foreign nationals who need to file taxes must apply for one. For example, I know freelancers and contractors from other countries who work in the U.S. They needed their ITINs to comply with tax laws. You may also need one if you’re claiming tax treaty benefits or if a family member needs to be included in the tax return. Even if you’re not required to file a return right away, having an ITIN might open some doors for you in terms of financial services. Additionally, dependents who live abroad but still qualify for tax deductions can be included under your ITIN. Basically, if you’re dealing with any kind of U.S. tax obligation, there’s a good chance you’ll need one. So, understanding if you need it can save you time and puzzlement down the road!

The ITIN Renewal Process

Once you have your ITIN, don’t think of it as a forever number! They do expire. If you haven’t used your ITIN on a tax return for three consecutive years, it could be inactive, and you might need to renew it. The renewal process is similar to the initial application, as I’ll share from my own experience. When I realized mine was set to expire, I felt a little panic creeping in. But, I quickly gathered my documents, just like the first round, and submitted my renewal application along with form W-7 again. You will also need to verify those identifying documents. I’d recommend checking your ITIN status on the IRS website for specific timelines and requirements. Remember that renewal is also useful if your ITIN was issued before 2013; those numbers likely have expiration dates that need to be reviewed too! So, don’t let it sneak up on you. Staying up to date with your ITIN is essential to staying compliant with the IRS and keeping your peace of mind. After all, nobody wants surprise tax complications!

Submitting Your ITIN Application

Once you’ve gathered your documents and completed Form W-7, it’s time to submit your application! You can actually apply for an ITIN through three ways; by mail, in-person at an IRS Taxpayer Assistance Center, or through an Acceptance Agent. Mail submission is the most common method. You’ll need to send the form along with your documents, and it can take several weeks for the IRS to process your application. I remember sending mine off and obsessively tracking the processing time each day—it’s just natural to worry, right? When visiting an Acceptance Agent, they’ll help you fill out your forms and also verify your documents, saving you that extra hassle of mailing in. But, if you choose that route, make sure their services are accredited by the IRS. Bear in mind there is no fee to apply for the ITIN itself, but you might encounter some costs associated with document verification or the agent’s assistance. Just take it step by step, and before long, you’ll be on your way to navigating the U.S. tax system like a pro!