Check the ITIN application guide, how to avoid common pitfalls, and maximize your financial opportunities in the U.S.

What is an ITIN?

So, let’s talk about what an ITIN actually is. An ITIN, or Individual Taxpayer Identification Number, is a nifty little nine-digit number issued by the IRS. It’s primarily designed for individuals who are required to file taxes in the U.S. but don’t have a Social Security Number. This could be popular among non-resident aliens, foreign nationals, and sometimes even dependents. You might think, ‘Why do I need this?’ Well, having an ITIN enables you to comply with U.S. tax laws and helps you unlock benefits like opening a bank account or applying for loans!

I can remember when I first heard about ITIN—it was during a tax seminar where everyone seemed confused about it. Finally, the speaker laid it all out, and it clicked. I realized that an ITIN isn’t just a bureaucratic hassle; it’s actually a tool to help you participate in the financial system and manage your tax obligations responsibly. Plus, it’s kind of reassuring to have, especially if you’re planning to stay in the States for a while and want to set your financial foundations straight.

Common Pitfalls to Avoid

When applying for an ITIN, there are a few common pitfalls you definitely want to avoid. First and foremost, make sure that all your documentation is complete. Incomplete applications can easily get rejected—it’s pretty frustrating! I remember when a friend of mine missed a crucial document, and it delayed his application by weeks. Another thing to keep an eye on is ensuring that the Form W-7 is completed correctly. Even minor errors can throw a wrench in your process and lead to rejections or delays.

It’s also really important to differentiate between ITINs and SSNs because they are not interchangeable. Sometimes, individuals mistakenly use one instead of the other, thinking it’s the same, and that’s just not true. Lastly, don’t forget to follow the timelines. If you’re applying close to tax season, be aware that processing times may be longer. Just remember—being diligent and careful in preparing your application will save you headaches down the road.

Who Needs an ITIN?

Now, you might be asking yourself, ‘Do I really need an ITIN?’ The answer largely depends on your tax situation. If you’re a non-resident alien or foreign national earning income in the U.S., then yes, you will need an ITIN to file your tax return and avoid any penalties. But don’t forget about your dependents! If they’re not eligible for a Social Security Number but you want to claim them on your taxes, they’ll need an ITIN too.

I’ve seen friends go through this just because they brought their families along for work assignments, and getting the ITIN became a key step in getting everything sorted on their tax forms. Even business owners who aren’t U.S. citizens might need one if they plan to engage in certain transactions or file taxes. So, if you think you might fall into any of these categories, it’s time to roll up your sleeves and start the application process. It may sound daunting, but we’ll get through it together!

What Happens After Application?

Once you’ve submitted your ITIN application, what’s next? Well, you sit back and try to relax while you wait for your ITIN to come through. Usually, it takes about 7 weeks, but I’ve heard of cases where it can take a bit longer, especially during busy tax seasons. Keep in mind that if there are issues, the IRS will reach out for additional information. Staying patient can be tough—I remember eagerly checking my mailbox every day when I applied! Once you receive your ITIN, you’ll want to keep it safe and remember that you can use it for various tax filings, so don’t lose it.

And remember, your ITIN doesn’t expire unless there is no activity for a period of three consecutive years; that’s a relief! Once you get into the groove of using your ITIN, you’ll find it really helps streamline your tax process, and you’ll be grateful you went through the application process! So, celebrate! You’ve earned it, and your financial world is about to feel a whole lot easier.

Maintaining Your ITIN

Now that you’ve got your ITIN, you might be wondering how to maintain it properly. This is actually important because you want to make sure it’s still valid for when you actually need it. First things first, keep your information up to date. If your name changes, for example, due to marriage or other reasons, you need to inform the IRS. I learned this the hard way when my cousin got married and forgot to report her name change, leading to mismatches when she filed her taxes! Also, remember that an ITIN becomes inactive if you don’t file a federal tax return for three consecutive years.

So, even if you think you won’t need it for a while, filing a return is crucial to keep it alive. Lastly, when filing your tax return, be careful to input your ITIN correctly—double-check those digits! All in all, taking a bit of time to maintain your ITIN will save you plenty of future headaches down the line. Take care of it like you’d care for a valuable tool in your financial toolbox!

Steps to Apply for an ITIN

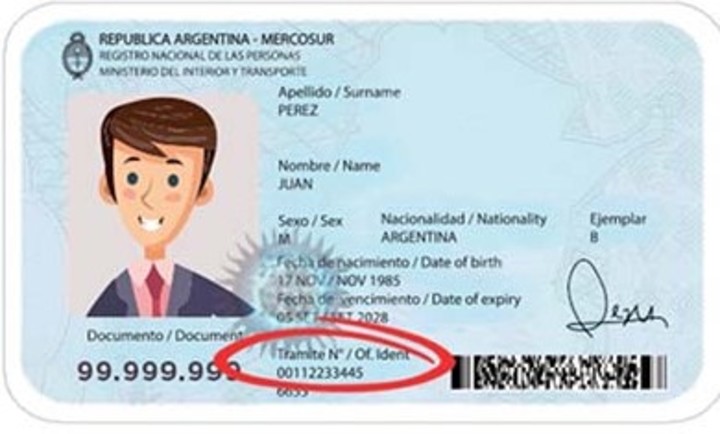

Alright, let’s roll up our sleeves and figure out how to apply for an ITIN. First off, you’re gonna need to fill out the IRS Form W-7, which is the application for the number. This form can be a bit overwhelming, but don’t sweat it—it’s all about collecting the right documentation. You’ll need proof of identity and foreign status, like a passport or national ID card, and depending on your situation, other documents may be needed too.

Trust me, when I did it, I thought it was a hassle until I found a checklist that helped me gather everything! Once you’ve got those ducks in a row, you can submit your application either by mail or through an IRS-authorized acceptance agent. I was in a rush, so I opted for the agent route, and it was smoother than I expected! After you submit, it typically takes about 7 weeks to get your ITIN, so if you’re doing this for a tax deadline, be sure to plan ahead. Stay organized and patient; you’ll get there!