ITIN benefits and limitations, application steps, and common misconceptions. Get informed and take charge of your tax responsibilities today!

What is an ITIN?

An Individual Taxpayer Identification Number, or ITIN, is really important for various groups, especially non-resident aliens and those who are not eligible for a Social Security Number (SSN). I remember back when I was sorting out my finances, I found out about the ITIN while looking for tax help. It’s issued by the IRS and is designed to ensure that all individuals, regardless of their immigration status, can file their federal income tax returns. The ITIN is a nine-digit number, and it’s pretty easy to get one if you meet the requirements. You usually need to fill out Form W-7 along with a valid federal income tax return. This gives a chance for many to participate in the tax system, which I find pretty cool. But keep in mind that an ITIN doesn’t grant you legal status or the right to work in the U.S. It’s strictly for tax purposes. So, while an ITIN can pave the way for some financial opportunities, it’s still a government-issued number that comes with its own set of rules and limitations that one should know about.

How to Apply for an ITIN

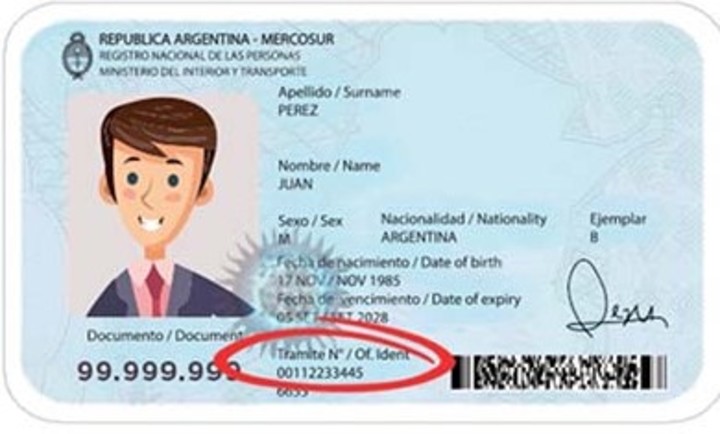

Applying for an ITIN is more straightforward than it might sound at first, and honestly, that’s a relief! You start by filling out Form W-7, which requires some personal information about yourself. I remember being in a similar position a while back and thinking it would be complicated, but it’s more about clarity than complexity. Along with the form, you need to submit a valid federal income tax return, and it helps to include documents that prove your identity and foreign status, like a passport or a residency card. The IRS has a list of acceptable documents, so you won’t be left guessing! You can mail this entire package to the address specified on the form. When I sent mine off, I felt a wave of relief! Just keep in mind that the processing time can take up to 11 weeks, so don’t rush or stress if you don’t hear back right away. You might even be able to visit a local IRS Acceptance Agent to help with the application, which is super handy! Just remember to check twice on everything so you don’t run into problems.

Benefits of Having an ITIN

Having an ITIN can open some doors you might not expect if you’re not a U.S. citizen or if you don’t have an SSN. For starters, it allows individuals to fulfill their tax obligations, which is super important, right? It’s one way to contribute to the community and that’s commendable! I recall how relieved my friend was when he learned about ITINs because he thought he wouldn’t be able to file taxes. Not only that, but it can also help in obtaining certain financial benefits, like opening a bank account. Many banks often require an SSN, but others accept an ITIN, which can feel welcoming. Then there’s the potential to access certain credits and deductions that could lower your tax bill. So, if you’re eligible, getting an ITIN isn’t just about being compliant, it can actually help you save some money! But remember, with great power comes great responsibility, so make sure you’re using your ITIN properly because it’s like having a special key to your financial opportunities.

Maintaining Your ITIN

Once you have your ITIN, it’s important to keep it maintained properly. This might sound a bit boring, but trust me, it helps prevent potential headaches down the line! For instance, your ITIN may expire if you don’t use it on a tax return for three consecutive years. That’s something I would totally forget about, and it could cause lots of issues later! It’s a good idea to stay on top of your tax filings, and if your status changes, make sure you update the IRS accordingly. What I’ve always found useful is to set reminders on my calendar to check when my next tax return is due! Also, if your ITIN was issued after 2012, you’ll need to renew it every five years, which can slip your mind, especially with busy life. Believe me, staying organized is key. Keep records of your filings and renewals, so when tax season comes around, you can tackle it smoothly. You want to keep everything aligned because mistakes can lead to delays or worse.

Common Misconceptions About ITINs

There are many myths about ITINs that can confuse people. Let’s clear up a few of the most common ones. Some believe having an ITIN allows you to work in the U.S.—but that’s not true. Only an SSN does that. Another common one is thinking that an ITIN leads to legal status or citizenship. It doesn’t, unfortunately.

It’s simply a tax identification number. It’s not a path to residency or a work permit. People also think an ITIN protects them from audits, but that’s completely false. The IRS can still audit you anytime. Having an ITIN doesn’t make you immune from legal obligations or IRS scrutiny. And no, ITINs aren’t just for undocumented immigrants. Students, investors, and others may need one too. So, get your facts right before relying on assumptions. Understanding how ITINs actually work can save you trouble.

Limitations of an ITIN

While it’s great to have an ITIN, there are also a bunch of downsides that anyone considering one should keep in mind. For one thing, an ITIN can’t be used for things like getting a job or receiving Social Security benefits, which is pretty crucial when you think about it! I can’t imagine having all the paperwork in order only to find out it doesn’t help in getting a job. The ITIN truly is just a tax number. Plus, if your status changes and you end up getting an SSN, you have to stop using the ITIN. That can sometimes lead to confusion or mistakes when filing taxes. Also, you should be aware that ITINs need renewal every few years, and failing to do that could mean you can’t use it for tax purposes. So it can be a bit of a hassle. It’s vital to stay organized if you’re going to hold on to this number. It can make life easier in some ways, but it also comes with responsibilities that can feel a bit overwhelming.