Learn the ITIN eligibility requirements, who needs one, and how to apply or renew it effortlessly. Get your ITIN today!

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a unique number issued by the IRS, designed for individuals who are not eligible for a Social Security Number (SSN). You might be wondering, why would someone need an ITIN? Well, it’s primarily used for tax purposes – allowing people, regardless of their immigration status, to file taxes. I still remember when my friend Maria, who moved from Mexico, needed one. She wanted to ensure she was contributing her fair share to taxes despite not having an SSN due to her visa situation. She applied for an ITIN and was relieved to find it fairly straightforward.

It’s an essential tool for the IRS to track tax obligations for foreign residents, non-resident aliens, and others in similar situations. Importantly, having an ITIN doesn’t change your immigration status or provide work authorization, which some individuals confuse. Instead, it serves to identify those who are engaging in the tax system. Understanding these distinctions is crucial and becomes evident while filling out forms or navigating financial situations in the U.S. In short, an ITIN is a significant step for many on their journey towards financial inclusivity.

How to Apply for an ITIN

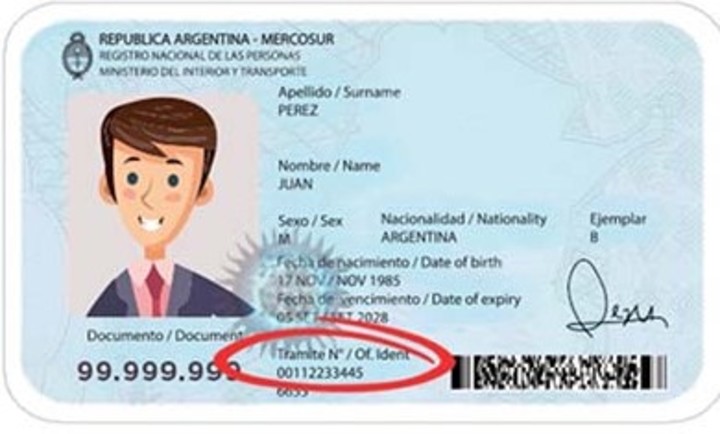

Applying for an ITIN is not as scary as it sounds! If you’re eligible, you can apply through the IRS by submitting Form W-7, along with your tax return, and, of course, the supporting documents I mentioned earlier. When I helped my friend fill out her form, we made it a bit of a project. It’s all about collecting proof of identity – like a passport or a birth certificate – and having those documents ready can help a lot. As you fill out that form, you’ll need to provide personal information like your name, address, and date of birth.

One pro tip I learned is to ensure that your name matches the one on your identification exactly, or you could find yourself in a bit of trouble when processing time comes. After you’ve completed the application, it’s best to mail everything to the address provided, or even better, you can go to an IRS Taxpayer Assistance Center for help! This personal touch can make the process smoother, especially if you have questions. And voila, soon you’ll have a shiny new ITIN to help with your taxes.

Who Needs an ITIN?

ITINs are particularly beneficial for a specific group of people. Typically, ITIN elegibility requirements include non-resident aliens who are obligated to file a U.S. tax return, dependents or spouses of U.S. citizens, and even foreigners who are not eligible for a Social Security Number. I had a neighbor once, Ahmed, who faced challenges due to his non-resident status while working here and wanted to send money back home. His accountant explained that without an ITIN, his tax obligations would be tricky to manage. This was an eye-opener for me because it highlights how universal being taxed can be, regardless of one’s legal status in America.

If you’re a foreign student or perhaps an employee of an unfamiliar task, like a temporary job, obtaining an ITIN becomes crucial to ensuring you remain compliant with U.S. tax laws. Not to mention, many banks and financial institutions also has some ITIN elegibility requiremenst to open accounts, which is an added incentive. Ultimately, having an ITIN can help individuals navigate their finances and ensure they participate in the economic landscape of the U.S.

Renewal of ITIN

Renewing an ITIN can be another area where folks feel a bit lost. It’s key to know that not every ITIN needs renewing – only those that haven’t been used on a tax return for the last three years or those issued before 2013 that haven’t been renewed. So, if you’re like my uncle, whose ITIN was issued ages ago and he just filed his first tax return in years, it would be time to get that renewed! The renewal process is pretty much the same as the application process. You’ll have to submit Form W-7 again, but this time without a tax return (unless required) if your ITIN wasn’t used actively. It’s a good idea to consider renewing well before tax season.

I remember last time, my uncle almost missed out because he waited until the last minute – and then, there’s all that anxiety! It’s about ensuring you’re compliant and continue to avoid any potential delays with your taxes. Just keep an eye on the timelines, and you’ll be good.

Common Mistakes to Avoid

When applying for an ITIN, there are several common mistakes that can trip up even the most careful applicants. One common pitfall is not providing the correct documentation or incomplete forms. The IRS can be picky – I remember hearing about someone who was rejected simply because they forgot to sign their application. Can you believe it? Also, it’s important to double-check your name, address, and all personal info to ensure it’s consistent with the documents provided. Another thing to keep in mind is sending in unnecessary documents; only provide what is specifically required by the IRS.

And here’s a tip: don’t forget to keep copies of everything you send; it’s super helpful if you need to follow up or reference something in the future. Lastly, be aware of the processing times. It usually takes about 7 weeks, and if you haven’t heard back after that, following up is a smart move. These simple but effective tips can help lighten the load and ensure a smooth process towards obtaining or renewing your ITIN.

Eligibility Criteria for ITIN

The eligibility criteria for obtaining an ITIN might seem a bit daunting at first, but once you break it down, it’s pretty manageable. To qualify for an ITIN, applicants must prove they’re not eligible to get a Social Security Number. This might include anyone who is a non-resident alien engaged in trade or business in the United States or someone who is a dependant or spouse of a U.S. citizen or resident alien.

I recall guiding my cousin through this process; he was starting business here and needed to file taxes. He had to fill out Form W-7, which involves providing proof of identity and foreign status – such as a passport, birth certificate, or a driver’s license. It can feel like a lot, but it was crucial for him to have the proper documentation. Furthermore, remember that ITINs are tailored solely for tax purposes and cannot be used for work authorization or identifying for other government benefits. It’s clear that being diligent about your eligibility can save you from headaches down the road.