Discover how to apply for an ITIN for dependents. Ensure compliance and access tax benefits with our easy step-by-step guide. Start today!

What is an ITIN?

An Individual Taxpayer Identification Number, or ITIN, is a unique number issued by the IRS. It’s primarily for people who don’t qualify for a Social Security Number (SSN) but still need to fulfill federal tax responsibilities. For instance, if you are a foreign national residing in the U.S. and working, you might be required to file taxes but can’t get a Social Security number. That’s when an ITIN comes into play! This nine-digit number ensures that even those who don’t have the traditional means of identification can still access the system. I remember the first time I helped a friend apply for an ITIN for his wife, who was an overseas student. It felt like unlocking a whole new world for her—she could finally file her taxes! It’s a vital resource for ensuring compliance within the tax system, and while it doesn’t provide eligibility for Social Security benefits, it does allow individuals to report income and pay taxes. Understanding what ITIN is can help clear any confusion that surrounds this important tool for many families.

Understanding ITIN Form W-7

Form W-7 is where the journey starts! This is the application form used to request an ITIN, and it has sections that might look overwhelming at first, but trust me, it’s not as complicated as it seems. The form includes providing your personal information, such as your name, mailing address, and the names of your dependents. A common hiccup people face is completing the sections relevant to their status correctly. For example, you’ll have to indicate the reason why you’re applying for an ITIN, whether it’s to file taxes or to claim a tax benefit. I usually circle back to this section to double-check, just to avoid any discrepancies. One time, a friend of mine put the wrong reason and it delayed their application! Also, note that if you’re applying on behalf of the dependent, your information needs to be clearly mentioned too. After filling out the W-7, it’s essential to review everything before submitting it—an extra pair of eyes really helps! Getting it right the first time can save you time and stress.

Who Needs an ITIN for Dependents?

Sometimes, families may find themselves in need of an ITIN for their dependents, especially if those dependents might not qualify for a Social Security Number. This typically applies to children or other relatives who are part of your household and are not U.S. citizens or residents. For instance, if you’re living in the U.S. on a work visa, and have a child born abroad, that child may need an ITIN if you plan to claim them as a dependent on your tax return. It’s like a step in the door— it allows you to take advantage of tax benefits! I once helped my neighbor with this very situation, where they were eligible for a child tax credit but didn’t have an ITIN for their new baby who was born while they were abroad. We navigated through the paperwork together, and once they submitted the application, it was amazing to see the relief on their face. They realized they were one step closer to getting the credits they desperately needed. So, yes, it’s essential to know when you need one for your dependents!

Required Documents for ITIN Applications

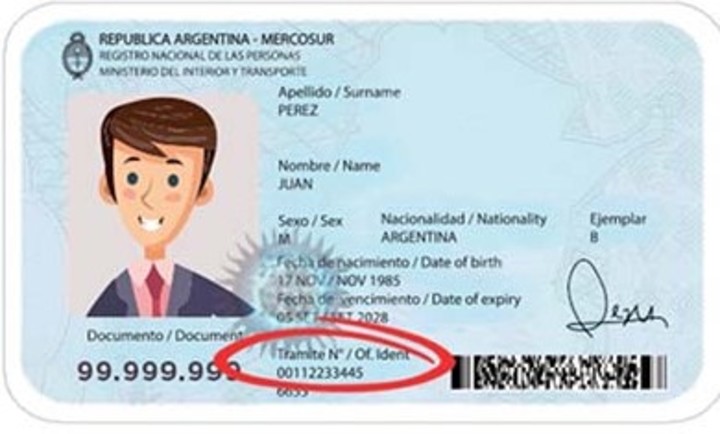

When applying for an ITIN for dependents, there are some important documents you’ll need to include. Most importantly, you’ll need to prove both the identity and foreign status of your dependent. This often can be accomplished with a valid passport, but there are other acceptable forms of identification like a birth certificate or a national identification card that can also work. Just remember that all documents must show the name of the dependent exactly as it appears on the Form W-7. It’s funny how something so small can lead to big headaches! A close friend of mine almost got tripped up by a minor detail like that. She provided a certificate without the proper name format, and it needed to be re-issued! Also, if you don’t submit original documents, you’ll need to provide certified copies from the issuing agency. This might seem like an extra hurdle, but it’s just the IRS’s way of protecting everyone. So make sure to gather everything you need ahead of time, to make the application process pretty smooth.

Common Mistakes to Avoid

Applying for an ITIN can be a straightforward process, but there are definitely some common mistakes to watch out for, particularly when it comes to dependents. One major oversight is submitting the application during the wrong tax season. It’s best to apply for the ITIN before tax filing, ideally at least a month in advance. This gives the IRS ample time to process it; otherwise, you might feel rushed. Another issue is failing to provide proper documentation or proof of identity as we talked about earlier. It’s easy to overlook the specifics, but double-checking those tiny details can save so much time later. Just like when I helped my friend last year with her application, she forgot to incorporate the date of birth for her daughter! And lastly, folks will sometimes forget to sign the W-7 form! Can you believe it? It’s the simplest thing, yet it can cause delays. So, watch out for those little bits, and double-check your application to ensure a smoother ITIN journey for your dependents!

How to Apply for an ITIN for Dependents

Applying for an ITIN for your dependents might seem daunting, but it’s actually quite straightforward! First, you’ll need to fill out Form W-7, which is the application for an Individual Taxpayer Identification Number. This form requires some basic information about the dependent, including their name, date of birth, and country of birth. One crucial step is providing proof of the person’s identity and foreign status, which can usually be done with a passport or other official documents. Remember, all documents submitted must be current! After you complete the form and gather necessary paperwork, you can send it to the IRS. When I helped my brother-in-law apply for his son’s ITIN, we actually went to an IRS Taxpayer Assistance Center. It made the process smoother! Though it can take about six to eight weeks to receive the ITIN, it’s worth the wait, especially for tax benefits. So, don’t let the application process intimidate you; it’s absolutely manageable with a little bit of prep!