Understanding ITIN for Non-Residents? Discover how to apply, who needs it, and tips to avoid delays. Secure your tax compliance!

What is an ITIN?

Individual Taxpayer Identification Number (ITIN) is basically a tax processing number issued by the IRS (Internal Revenue Service) for individuals who aren’t eligible for a Social Security Number (SSN). So, if you’re a non-resident or a foreign national, and you need to file taxes in the U.S., this little number becomes pretty important. I remember a friend of mine who moved from Italy to the U.S. a couple of years back – he was completely lost when it came to taxes. All he wanted was to ensure he was compliant, but he didn’t have an SSN. That’s when he learned about ITINs! The IRS issues ITINs to ensure that everyone pays their fair share of taxes, regardless of residency status. It’s necessary for filing income tax returns, and it helps non-residents report their tax obligations accurately. So, if you’re in a similar situation, don’t stress too much – getting an ITIN can open up financial doors that make it easier for you to live and work in the U.S. more comfortably than you think.

Step-by-Step Application Process

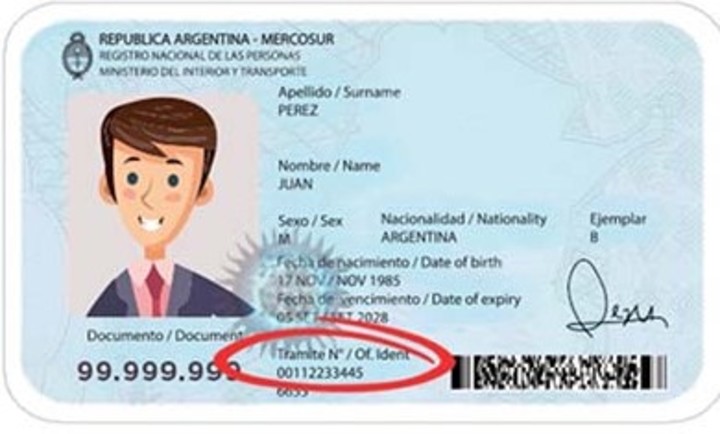

The process of applying and understanding ITIN for Non-Residents for can be broken down into several clear steps. First, gather your required documents such as a valid form of identification and proof of foreign status, like your passport – it’s pretty much a must-have. Then, fill out Form W-7 carefully! Don’t skip any sections, as odd as that may sound. It’s essential to ensure completeness to avoid unnecessary delays – believe me, I’ve been there before! Once that’s done, you’ll need to either attach this to your tax return or submit it separately. After submission, you might experience a sense of relief, but remember you should keep an eye out for any correspondence from the IRS. It’s crucial to provide correct information from the get-go, as errors can lead to rejections. Just imagine, all that hard work just to be sent back to you! Patience is key here; the process can take several weeks, so don’t panic if you don’t hear back right away. There are numerous resources available that can lend a helping hand if you’re uncertain.

Who Needs an ITIN?

Now, you may wonder, ‘Do I really need an ITIN?’ If you’re not a U.S. citizen and don’t qualify for a SSN but still need to file a tax return, then yes, you likely need an ITIN. This could be for various reasons – maybe you’re earning income from U.S. sources, or perhaps you want to claim tax treaty benefits. My neighbor, who’s a freelance graphic designer, went through a similar journey when he started working with American clients. Without an ITIN, he couldn’t report his income properly, which scared him a bit. He certainly didn’t want the IRS coming after him! Additionally, certain dependents or spouses of non-residents may also need an ITIN for tax purposes. For instance, if you’re filing jointly with a partner who has no SSN, you’ll need to include their ITIN. Remember, it’s all about compliance! Not having one when you need it could lead to difficulties, and no one needs that added stress when navigating a foreign financial landscape.

Common Reasons for Delays

Even when you think you’re all set, there are a few common pitfalls that can cause delays in obtaining and understanding ITIN for Non-Residents. One surprisingly frequent issue involves documentation errors – it’s easy to overlook something! For example, if the name on your Form W-7 doesn’t match the name on your supporting documents, it can throw your application into a confusing abyss. Another issue often stems from missing documents. It’s a good idea to make sure you keep everything organized and ready, especially if you’re juggling multiple paperwork. I remember my cousin stressing out because he was in the process of getting his ITIN and misplaced crucial documents! Talk about a headache! Additionally, if you submit your application during peak tax season, you might have to wait a bit longer since the IRS can be inundated with requests. It’s always wise to plan ahead, if you can, to avoid these delays! Just take a deep breath and keep checking your status – you’ll get your ITIN soon enough!

Maintaining Your ITIN

Obtaining an ITIN is one thing, but maintaining it is another! Once you have your ITIN, it’s important to keep it active by using it when filing your tax returns. If you don’t use your ITIN on a tax return for three consecutive years, it may expire, and that could compromise your ability to file taxes properly! I once had a good friend who thought it wasn’t a big deal to skip a year, but when he tried to file the following year, he had to go through the whole application process again – and let me tell you, it doesn’t just take a few days! So, as tedious as it may seem, make sure to file consistently. Also, keep yourself updated if your information changes, because any discrepancies might lead to future issues. It’s truly a wise move to stay organized and know when it’s time to reapply. If you have any worries, don’t hesitate to reach out for help. Staying on top of your ITIN game means you can focus on what really matters – living your best life!

How to Apply for an ITIN?

Understanding ITIN for Non-Residents may sound a bit daunting but trust me, it’s not rocket science! The first step usually involves filling out Form W-7, the application for IRS Individual Taxpayer Identification Number. You’ll need to provide documentation that proves your foreign status and identity – think passport, national identification card, or something of that nature. There are times when I think about how my sister went through this whole process when she moved to Canada for her studies. She actually found it surprisingly straightforward, though she was really nervous at the beginning. If you’re filing a return, you will often submit your W-7 along with your return. Alternatively, you can apply in person at designated IRS Taxpayer Assistance Centers or use an Acceptance Agent who can help verify your documents. Just a helpful tip: double-check that everything is accurate before sending it off! A small mistake could delay the process and nobody likes waiting, right? In a nutshell, take your time and double check everything!