Discover the ITIN and immigration status, it’s importance, and common myths. Take control of your tax obligations and financial future today!

What is an ITIN?

An ITIN, or Individual Taxpayer Identification Number, is primarily intended for individuals who are not eligible for a Social Security Number (SSN). It’s widely used by non-residents and those who don’t have the necessary ITIN immigration status to apply for an SSN. When I first learned about ITINs, I was surprised by how many people actually rely on them for various financial processes. They’re crucial for fulfilling tax obligations. You might’ve heard stories about someone who had trouble with their taxes just because they didn’t have an ITIN. This number allows people to report their earnings to the IRS, even if they’re not citizens. Plus, it facilitates access to certain benefits like opening a bank account or applying for a credit card. That’s vital, especially for folks trying to build their financial future in the U.S. Having an ITIN helps ensure that everyone, regardless of their ITIN immigration status, plays their part in contributing to the tax system. But remember, obtaining an ITIN doesn’t give you legal status or authorize you to work in the U.S. It’s just a number that serves specific tax-related purposes.

How to Obtain an ITIN

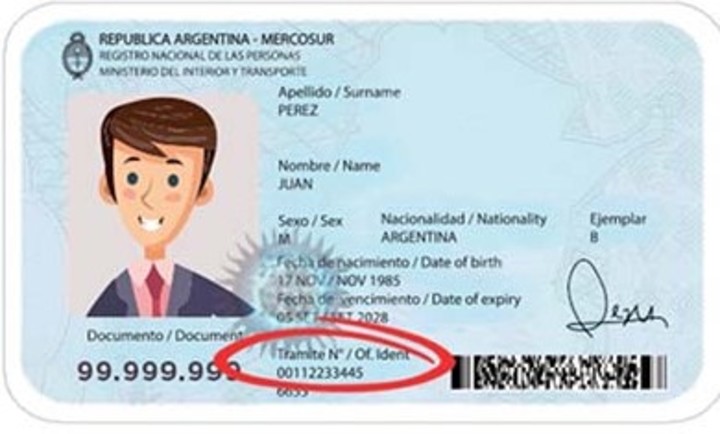

Obtaining an ITIN is a detailed process, but I remember the satisfaction I felt when I finally held mine! First things first, you need to fill out Form W-7, which is the application for an ITIN. It seems daunting at first, but breaking it down can make it manageable. You’ll also have to provide documentation that substantiates your foreign status and identity, like a passport or a birth certificate. It’s really crucial to make sure each piece of documentation is accurate and legible, or else you’ll face unnecessary delays. One thing I learned is that I can apply for an ITIN even if I’m not required to file taxes immediately. The IRS suggests submitting the application alongside your tax return to expedite the process. You can also apply through an Acceptance Agent or at some local IRS offices. I found that community organizations often host sessions to help with the entire process. Regardless of how you decide to apply, being patient is key! It might take several weeks to get your ITIN, but it’s worth it in the long run.

The Importance of Immigration Status

Immigration status is critical for so many aspects of life in the United States. It’s not just about legal residency; it impacts employment opportunities, access to healthcare, and even education. The first time I realized how deeply immigration status affected someone’s life was when a friend of mine, who migrated here from Mexico, shared her struggles with finding a job. She had an ITIN but no work authorization, making her feel stuck. People in various immigration statuses face unique challenges every day. For instance, those who are undocumented may fear deportation, limiting their ability to seek help for anything, even in emergencies! Those with green cards enjoy more privileges, but they still navigate the complexities of maintaining their status. It’s a constant balancing act. Knowing about one’s immigration status can provide a sense of direction and empowerment. It’s important to be informed, so individuals can make educated decisions based on their specific situation. Overall, understanding the ITIN immigration status can also lead to a greater appreciation of the diverse experiences within our communities.

Common Myths about ITINs

So, there are quite a few myths about ITINs floating around! One common misconception is that having an ITIN grants you legal immigration status—a total myth! Having an ITIN doesn’t change a person’s immigration status; it’s strictly for tax purposes. I remember chatting with someone who thought that getting an ITIN would solve all their problems and help them stay in the U.S. That misconception can lead to so many misunderstandings! Another myth is that you can only get an ITIN if you’re a non-resident. That actually isn’t true; residents who don’t qualify for an SSN can also apply for an ITIN! And one more that I find amusing is the idea that you can’t get any tax refunds with an ITIN. Spoiler alert: you can! If you’re eligible, you might even get refunds, just like SSN holders do. It’s important to bust these myths to help clearer the understanding of what an ITIN really is and its role in the tax landscape.

ITINs and Future Changes

As we chat about ITINs, it’s essential to keep an eye on future changes that might affect how it all works. For instance, the IRS frequently updates its policies to conform to changes in tax laws. I once found out the hard way that an ITIN can expire if it’s not used on a tax return for three consecutive years. Imagine my panic when I learned I might need to start from scratch! Changes like these can majorly fluctuate people’s plans. Experts predict we might see efforts for broader immigration reforms over the next few years, which could influence the ITIN system. Staying well-informed is key; attending workshops or subscribing to updates from trusted tax professionals can help. Remember, tax laws can feel like a maze, but knowing what to expect can ease that anxiety a bit. I always encourage people to build a community around these topics—having a circle of friends who understand the struggles you’re facing just makes it easier. Keeping an open dialogue about potential changes means we can prepare accordingly, ensuring we handle our finances the best we can!

Navigating Taxes with ITINs

When tax season rolls around, many folks with ITINs might feel a mix of anxiety and confusion. Personally, I’ve been there—sitting at my kitchen table with receipts spread all over, feeling overwhelmed. Navigating taxes with ITINs can be tricky, especially if you’re unfamiliar with the system. One key point to remember is that ITIN holders must still file tax returns, even if they have to pay no taxes. But here’s the kicker: it’s essential for opening the door to potential tax credits, which can truly make a difference. For instance, qualifying for the Earned Income Tax Credit can significantly help low-income families. Additionally, it’s crucial to stay updated on tax laws because they can change, sometimes without much warning! I recommend talking to tax professionals or utilizing trusted resources, as they can make the process smoother. Other than that, many community organizations host workshops to assist ITIN holders during tax season. So, if you feel lost, don’t hesitate to seek support. After all, tax season doesn’t have to be a solo journey. You can find collectives of people navigating the same challenges.