What is an ITIN?

An ITIN, or Individual Taxpayer Identification Number, is a crucial aspect of the U.S. tax system, especially for many international students. Think of it as a social security number for those who don’t qualify for one. Essentially, if you’re a non-resident alien who needs to file a tax return, the ITIN is your go-to solution. I remember when I first learned about ITINs during my college orientation. Everyone seemed anxious about taxes, and it was this whole new world for us! The IRS uses the ITIN to track your tax obligations, so it’s important to get one if you plan to earn income in the U.S.

Even if you’re just receiving a scholarship or fellowship, an ITIN can help you navigate tax filing more smoothly. It’s not just reserved for employment; it’s also applicable for earning money through investments or any other taxable income. Just keep in mind that having an ITIN does not change your immigration status, so you still gotta be mindful of that part of it. Getting one is a straightforward process, which I’ll explain shortly, but understanding its importance is a great first step.

Common Myths about ITINs

There’s quite a few myths floating around about ITINs, and I get it! When I first heard about them, I was so confused. One common misconception is that having an ITIN helps you gain residency or citizenship in the U.S. Unfortunately, that’s not quite right. The ITIN is specifically for tax reporting purposes and does not impact your immigration status in any way. Another myth that I stumbled across was that an ITIN guarantees you can file taxes with no additional documentation. While it’s important for reporting income, you still need to have the proper documents in hand for your individual tax situation.

I also remember hearing someone say you only need an ITIN if you work full-time – totally not true! Part-time work, fellowships, or even certain scholarship disbursements can require an ITIN as well, so it’s vital to understand your unique situation. Clear any misconceptions before diving into the process, so you’re well-informed and confident in what steps to take.

Who Needs an ITIN?

You might be wondering if you really need an ITIN as an international student. Well, if you’re planning to work, even part-time, or if you’re receiving grants, scholarships, or fellowships that may be subject to U.S. taxes, the answer is likely yes! I remember a friend from my dorm who received a scholarship but hadn’t applied for an ITIN – it caused all sorts of issues during tax season. You see, non-resident aliens are sometimes required to file taxes, even if they’re only in the U.S. temporarily. If you find yourself in any income-generating role and need to report that income, an ITIN becomes essential.

Additionally, there are certain tax benefits or credits that might be available to you if you file taxes, but you need an ITIN. Even if you’re unsure about your situation, applying for one gives you an option to comply with IRS regulations and can ease any worries you might have about taxes. It’s worth the effort to understand your needs and act accordingly, trust me on this!

ITIN for International Students

Having your ITIN as international student can be a bit of a daunting task, but knowing about ITINs definitely helps ease the process. Once you’ve been issued an ITIN, you’ll use it when filing your tax return, typically Form 1040NR for non-resident aliens. I remember the sheer anxiety I felt the first time I filled out that form. It’s important to keep track of your income throughout the year, whether it’s from a job, a scholarship, or another source. A fun tip is to keep organized records in a folder—trust me, this saves a lot of headaches later. You also can’t forget about state taxes if that apply to you; sometimes, they have their own specific requirements.

You’ll want to do a bit of research to be informed about the way things work in your state. Seeking help from a professional tax advisor familiar with non-resident returns can also make a huge difference. They can guide you through tax deductions and credits you might not even realize you’re eligible for. Knowledge is power, especially when it comes to finances!

Important Deadlines to Remember

As an international student, keeping track of tax deadlines is super essential to avoid penalties or missed opportunities. The main tax deadline in the U.S. is usually April 15, but for non-resident aliens, it may vary, especially if you’re not earning any income. I remember my first year panicking because I thought I had to submit my forms the same day as my friends; turns out, they had different requirements.

So first things first: if you’re going to file a tax return, make sure you know the exact date that applies to you. Sometimes, if you’re not making enough money, you might not have to file at all! And when applying for an ITIN, it’s recommended to do it as early as possible, so you have it by the time tax season rolls around. If you miss the deadline, penalties can pile up quickly, so keeping an organized calendar can be a lifesaver. You see? You don’t want to end up in a tricky situation during tax time, it’s best to stay prepared and ahead of the game!

How to Apply for an ITIN

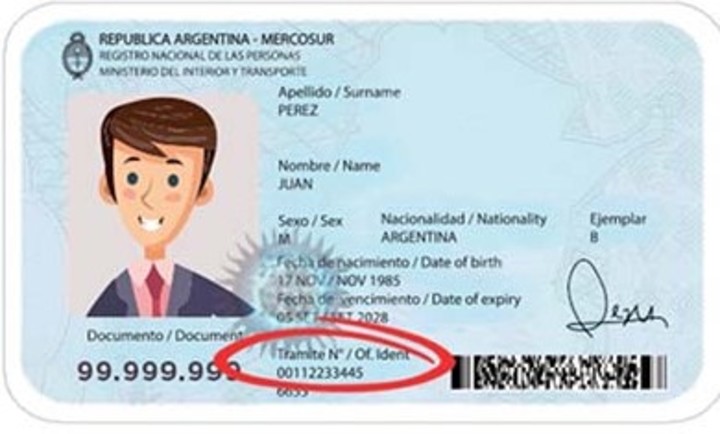

Applying for an ITIN is actually easier than it might sound. First off, you’ll need to fill out the IRS Form W-7. When I filled mine out, I was a bit anxious about getting it right, so I made sure to double-check all the requirements. You can either apply by mail or in-person at designated IRS offices; just be sure to have the proper documents. You’ll need proof of foreign status and identity, which usually means passport, visa, or other government documents.

I vividly remember having to gather all my paperwork like it was a treasure hunt! Once you send in your application, it typically takes several weeks to get your ITIN. Patience is key during this time, as I had a friend who thought it was going to be an instant process, and it wasn’t! Also, make sure you keep the ITIN in a safe place once you get it. It’ll be crucial for your tax filings moving forward, so remember to hang onto that number and treat it with care!