ITIN Tax Filing Tips! Discover filing tips, deadlines, and common mistakes to avoid for a smooth tax season.

Understanding ITIN Basics

If you’re unfamiliar with what an ITIN is, it stands for Individual Taxpayer Identification Number. Basically, it’s a nine-digit number that the IRS assigns to individuals who are required to have a U.S. taxpayer identification number but do not qualify for a Social Security number. This can be particularly important for non-resident aliens and foreign nationals who need to file a U.S. tax return. It’s a common misconception that ITINs are solely for undocumented individuals, but that’s not true. I remember when I first learned about ITINs, I thought it was just for people who were, you know, living under-the-radar, but then I discovered it actually helps people comply with tax laws. Having an ITIN is super helpful because it allows you to file your taxes, claim refunds, and even open a bank account. Plus, it’s a way for the IRS to keep track of your tax obligations too. So, if you’re in that category, knowing that you can obtain an ITIN and understand its purpose is first step to ensuring you meet your tax responsibilities without any hiccups through the process.

Filing Deadlines to Note

Alright, let’s talk deadlines! It’s that pesky issue that sneaks up on us every year, am I right? When you have an ITIN, the standard tax-filing deadline is typically April 15th, unless you file for an extension. But here’s a little thing that I learned the hard way: if you miss that deadline, you could face penalties or late fees that can really add up. Back in the day, I thought extending my filing time was just about having more time to chill, but it’s way more nuanced than that. You’ll need to file for an extension if you think you’re going to push the date, and by doing that, you’ll usually have until October 15th. Just make sure to pay any taxes owed by April 15th to avoid penalties. Planning ahead can really ease the stress of tax season. Keeping a calendar with reminders can help keep you on track. Remembering these dates will save you from those “uh-oh!” moments, especially if you’re juggling a million other responsibilities.

Gathering Required Documents

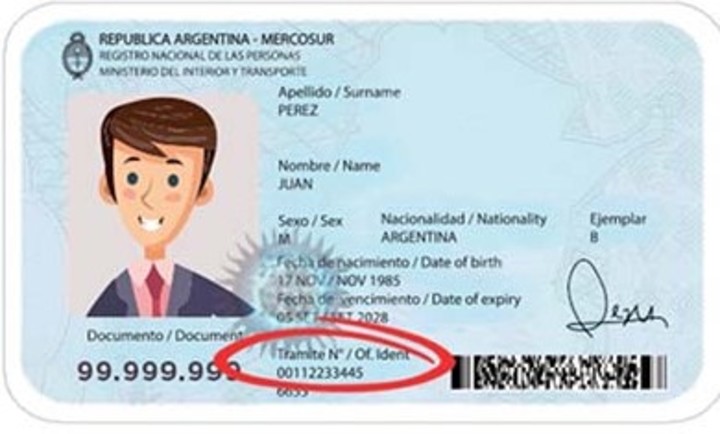

Now that you understand what an ITIN is, the next step is gathering the necessary documents to actually apply or renew one. You’d be surprised at how important that is! Typically, you’ll need your Form W-7, which is like the ticket to getting your ITIN. Alongside that, you’ll need to provide proof of identity, and proof of foreign status, which can be accomplished with documents like a passport, national ID card, or even a driver’s license. I remember my first time gathering the paperwork; it felt like I was assembling a puzzle where certain pieces seemed to vanish! But hey, take your time to double-check everything. Sometimes the information could be in different languages, which can be a hassle. Don’t worry too much if you don’t have everything that’s super official—there are options! Above all, make sure the names and dates match up across all documents, because those small things can really trip you up. It’s a little daunting, but trust me, once you cross that hurdle, you’ll feel more at ease about your taxes.

Common Mistakes to Avoid

Oh boy, let’s talk about the little things that can trip you up when filing with an ITIN. One common error I noticed, especially when helping friends, is not checking the accuracy of the information on your application. Make sure your name, address, and ITIN number are all correct and uniform across the board. It might seem like a small detail, but it can lead to delays. Another mistake is forgetting to renew your ITIN. Yes, those numbers expire! If you haven’t used your ITIN in the past three years, it could become inactive, leaving you scrambling at the last minute. I can tell you from experience, the fear of the IRS is real, and seeing a rejected return because of something so simple is super frustrating. One other slip-up is not taking advantage of available resources. There are resources and assistance available through community organizations that can help with your tax filing. Don’t hesitate to reach out and ask for assistance if you’re feeling lost, because it sure makes a difference. These little oversights can become major headaches, so stay alert!

Seeking Professional Help

Sometimes, we all need an extra hand, don’t we? Seeking professional help when filing taxes with an ITIN can totally save time and reduce stress. I recall the first time I attempted to go solo thinking I could nail it all. Let’s just say, it was a roller coaster ride! There’s so much to figure out: forms, rules, and deductions—it can feel like you’re drowning in paperwork! Hiring a tax professional who specializes in ITIN filings could really bring peace of mind. They can give you insights that you might not even consider; trust me, having that expertise makes a world of difference. There are free resources available too, like Volunteer Income Tax Assistance (VITA) programs, which provide incredible support to people who need help navigating the process. Plus, your local community might have resources specifically tailored for ITIN holders. Just remember to do your research, check reviews, and feel comfortable with whoever you choose to work with. Getting a personal touch can turn tax season into something more manageable, rather than feeling like a daunting task. So don’t hesitate, reach out for help!

Filing Your Taxes with an ITIN

Filing your taxes with an ITIN might seem like a complex topic, but I’m here to ease those nerves! To get started, after you have your ITIN, you’ll want to adjust your filing strategy accordingly. Make sure you use your ITIN on all tax forms in place of a Social Security number. This is crucial! If you try to file without an ITIN, your tax return could end up getting delayed or even rejected, and no one wants that. The IRS Form 1040 is typically the standard form that folks use to file, so be sure to fill that out correctly. You may also want to consider utilizing tax software specifically designed for ITIN users or even seek the help of a tax professional who understands the ins-and-outs of ITIN tax filing. Oh, and don’t forget to watch out for potential deductions you might qualify for, like the Child Tax Credit, which can sometimes apply! Remember my friend who was lost with his taxes? Taking the right steps didn’t just put him at ease; it actually saved him some cash too. So, get those forms ready and file on time!