What is an ITIN and why do you need one? An ITIN, or Individual Taxpayer Identification Number, is a unique nine-digit number issued by the Internal Revenue Service (IRS) specifically for individuals who must comply with U.S. tax laws but cannot obtain a Social Security Number (SSN). This number helps the IRS manage tax obligations and ensures that those without SSNs can meet their tax reporting requirements effectively.

Who Needs an ITIN and What It Is Used For

An ITIN is essential for various individuals, including:

- Non-resident aliens who need to file a U.S. tax return due to income earned within the U.S.

- U.S. resident aliens who meet residency requirements and need to file tax returns.

- Dependents or spouses of U.S. citizens or resident aliens who need to be included in tax filings.

- Dependents or spouses of non-resident aliens who have U.S. tax obligations.

- Foreign nationals involved in U.S. transactions who need to report income or claim tax benefits.

The ITIN is used exclusively for federal tax reporting. It does not provide work authorization, eligibility for Social Security benefits, or change immigration status. Its primary function is to ensure that individuals without an SSN can fulfill their tax obligations.

Why You Should Use Our Services for Your ITIN Application

Applying for an ITIN involves several complex steps that can be challenging to navigate on your own. Here’s why you should leave it to us:

- Form W-7 Completion: Filling out Form W-7 accurately is critical and can be confusing. We handle this form to ensure it is completed correctly, avoiding common errors.

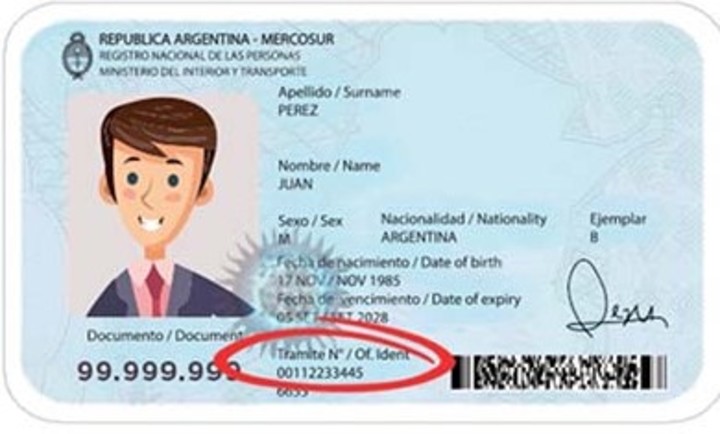

- Document Verification: You need to provide specific documents to verify your identity and foreign status, such as a valid passport, driver’s license, or national ID card. Gathering and validating these documents can be time-consuming and complicated. We manage this process to ensure all required documents are correctly compiled and submitted.

- U.S. Federal Tax Return: Including a U.S. tax return with your ITIN application can be complex. We assist with preparing and submitting this document as needed, ensuring that your application meets all requirements.

- Avoiding Common Mistakes: Mistakes in the application process, such as incomplete forms or incorrect documentation, can lead to delays or rejections. We help you avoid these pitfalls, ensuring your application is processed smoothly.

Complications of DIY Submissions

- By Mail: Sending your ITIN application by mail involves several steps, including ensuring that all documents are correctly addressed and sent to the right IRS office. This process can be cumbersome and prone to errors.

- In Person: Submitting your application at an IRS Taxpayer Assistance Center or through an IRS-authorized Acceptance Agent can be extremely tedious. It often requires navigating complex procedures, long wait times, and understanding IRS protocols.

- Online: Although some aspects of the application process can be tracked online, the initial application cannot be completed online. This means additional steps and potential complications.

Let us handle the intricate and time-consuming details of your ITIN application, making the process straightforward and hassle-free for you.